Introduction

Investment & Digital Economy Division processes Foreign Direct Investment (FDI) applications and handles policy issues related to Overseas Direct Investment; negotiates India’s Bilateral Investment Treaties (BITs) and manages disputes arising from these treaties/agreements; fosters Global partnerships in fintech to enhance India’s digital economy; examines policy issues related to Domestic Investment; handles policies matters related to the import and export of gold and silver, and financialization of gold.

Investment & Digital Economy Division consists of six sections under Investment & Digital Economy Division, viz. (i) Domestic Investment Section, (ii) Digital Economy and Fintech Section, (iii) Foreign Direct Investment Proposal Section, (iv) Foreign Direct Investment & Overseas Direct Investment Policy Section, (v) International Investment Treaties & Framework Section and (vi) Foreign Trade & Services Section.

Mandate of the Division

Investment Division ensures fair and objective processing of Foreign Direct Investment (FDI) applications (which do not fall under the automatic route) and facilitate cohesive management of FDI policies in collaboration with ministries and regulators. This Division negotiates Bilateral Investment Treaties (BITs) with countries as reciprocal commitment to protect foreign investment, Investment Protection and Promotion Agreements, creating a favorable environment for foreign investments in India and Overseas Indian investments and streamlining the repatriation of business proceeds. It manages disputes arising from these treaties/ agreements and represents India in international forums such as BRICS, G20 UNCITRAL, UNCTAD and WTO regarding investment-related issues. The Division fosters global partnerships in fintech to enhance India’s digital economy, addressing necessary policy interventions and infrastructure gaps. It handles policy issues related to Overseas Direct Investment and outward investment from India. It oversees foreign exchange policies related to the import and export of gold and silver, including the financialization of gold. It handles matters related to management of National Investment and Infrastructure Fund (NIIF Master Fund), NIIF Fund of Funds-I (NIIF FOF), India Japan Fund (IJF), US-India Green Transition Fund (USIGF), Special Window for Affordable and Middle Income Housing (SWAMIH) and some matters related to Research, Development and Innovation (RDI) Fund.

It also has the responsibilities of following sectoral Ministries/ Departments/Organisations such as Ministry of Electronic and Information Technology, Ministry of Textile, Department of Chemicals and Petro-Chemicals, Ministry of Commerce, Ministry of Heavy Industries, Ministry of Micro, Small & Medium Enterprises, Ministry of Steel, Department of Public Enterprises , Department for Promotion of Industry and Internal Trade, including Make in India, Ease of Doing Business and Startup; External territorial charge of Central and South American Nations.

Investment & Digital Economy Division consists of six sections under Investment & Digital Economy Division, viz.

- International Investment Treaties & Framework Section,

- Foreign Trade & Services Section

- Domestic Investment Section

- Digital Economy and Fintech Section

- Foreign Direct Investment & Overseas Direct Investment Policy Section

- Foreign Direct Investment Proposal Section

Schemes / Projects of the Division

Gold Monetisation Scheme (GMS), 2015

The Government of India announced the Gold Monetisation Scheme vide its Office Memorandum F.No.20/6/2015-FT dated September 15, 2015. The objective of the Scheme is to mobilise idle gold held by households and institutions of the country and facilitate its use for productive purposes, and in the long run, to reduce country’s reliance on the import of gold. The Gold Monetization Scheme comprises of the previous 'Gold Deposit Scheme’ and the 'Gold Metal Loan’ scheme, revamped and linked together in GMS.

Click here to read more about Gold Monetisation Scheme, 2015

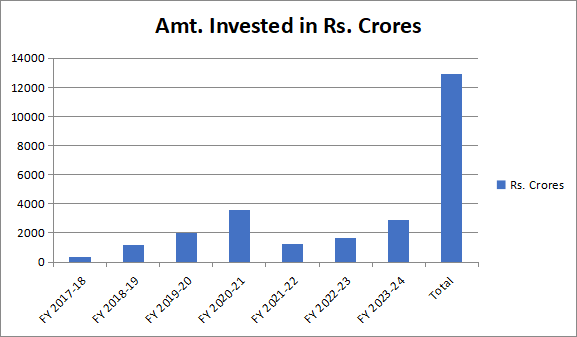

National Investment and Infrastructure Fund

The intention to create National Investment and Infrastructure Fund (NIIF) was to attract equity investments from both domestic and international sources for infrastructure development in commercially viable projects, both greenfield and brownfield, including stalled projects. NIIF was registered as a Category II Alternate Investment Funds (AIF) under SEBI Regulations. The Fund is managed by National Investment and Infrastructure Fund Limited (NIIFL). Currently, there are three funds under the NIIF Umbrella. They are NIIF Master Fund, NIIF Private Market Fund-I, NIIF India Japan Fund.

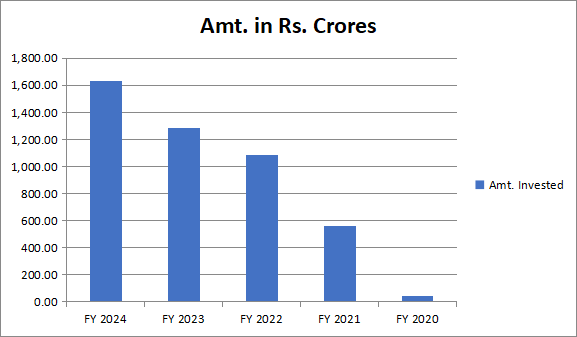

Special Window for Affordable and Mid-income Housing (SWAMIH) Investment Fund I

The Fund was incorporated in December 2019 to set up a ‘Special Window’ in the form of AIF to provide priority debt financing for the completion of stalled/stressed housing projects. The Fund is managed by SBICAP Ventures Ltd. a subsidiary of State Bank of India. The investment objective of the Fund is to complete construction of stalled / stressed residential development across geographies - pan India.

Contact details of the Divisional Head

Ms. Reetu Jain

Economic Advisor (Investment & FSRL)

Phone011- 23094443

International Investment Treaties & Framework (IITF) Section

| Name | Designation | Room No. | Telephone No. | |

|---|---|---|---|---|

| Shri Dhruv Chakravarty | Director | 57, North Block | 011-23095057 | dhruv[dot]chakravarty[at]nic[dot]in |

| Ms. Preeti Jain | Director | 66-C, North Block | 011-23094045 | preeti[dot]jain[at]nic[dot]in |

| Ms. S. Divyadharshini | Director | 32A, North Block | 011-23092908 | divyadharshini[dot]s[at]nic[dot]in |

| Ms. Yashaswini Saraswat | Deputy Director | 30, North Block | 011-23092225 | y[dot]saraswat[at]mha[dot]gov[dot]in |

| Ms. Leena Kumar | Deputy Director | 63, North Block | 011-23095756 | leena[dot]kumar[at]nic[dot]in |

Foreign Trade & Services (FT) Section

| Name | Designation | Room No. | Telephone No. | |

|---|---|---|---|---|

| Shri S. Satyanarayana | Director | 269A, North Block | 011-23095204 | s[dot]sudhaveni[at]nic[dot]in |

| Shri Thyelsaangphom Khaling | Under Secretary | 276-G, North Block | 011-23092480 | t[dot]khaling[at]nic[dot]in |

Domestic Investment (DI) Section

| Name | Designation | Room No. | Telephone No. | |

|---|---|---|---|---|

| Shri Syed Zubair Husain Noqvi | Director | 67-A(II), North Block | 011-23094172 | syed[dot]zubair[at]nic[dot]in |

| Shri Rajiv R. Singh | Director | 48-D, North Block | 011-23095058 | rajiv[dot]singh[at]nic[dot]in |

| Shri Rajendra Kumar Meena | Deputy Director | 250 B, North Block | 9413556686 | rajen[dot]km[at]gov[dot]in |

| Shri Santosh Kumar Agarwal | Under Secretary | 161 A, North Block | 011-23095073 | santoshkumar[dot]agarwal[at]nic[dot]in |

Digital Economy and Fintech (DE) Section

| Name | Designation | Room No. | Telephone No. | |

|---|---|---|---|---|

| Shri. Harsha Bhowmik | Director | 66-B, North Block | 011-23092494 | harsha[dot]bhowmik[at]gov[dot]in |

| Shri Rajendra Kumar Meena | Deputy Director | 250-B, North Block | 9413556686 | rajen[dot]km[at]gov[dot]in |

Foreign Direct Investment & Overseas Direct Investment Policy (FDI & ODI Policy) Section

| Name | Designation | Room No. | Telephone No. | |

|---|---|---|---|---|

| Shri Asif Ismail | Deputy Secretary | 67 A - III, North Block | 011-23094413 | asifismail[at]ord[dot]gov[dot]in |

| Shri Rajesh Kumar Yadav | Deputy Director | 251, North Block | 011-23092491 | rajeshkyadav[at]nic[dot]in |

Foreign Direct Investment Proposal (FDI Proposal) Section

| Name | Designation | Room No. | Telephone No. | |

|---|---|---|---|---|

| Shri Asif Ismail | Deputy Secretary | 67 A - III, North Block | 011-23094413 | asifismail[at]ord[dot]gov[dot]in |

| Shri Rajesh Kumar Yadav | Deputy Director | 251, North Block | 011-23092491 | rajeshkyadav[at]nic[dot]in |