About Us

The Chief Controller of Accounts, Ministry of Finance, is handling the payment and accounting functions for nine of the thirteen Grants/Appropriations pertaining to the Ministry of Finance. These nine grants account for over 80% of the expenditure of Government of India; the bulk of the expenditure pertaining to interest payments and redemption of debt.

Functions of the Chief Controller of Accounts

- The Secretary of each Department is the Chief Accounting Authority and is assisted by the Financial Adviser and the Chief Controller of Accounts in discharging the finance and accounting functions.

- The Chief Controller of Accounts (CCA) is in overall charge of the accounting organization of the Ministry. A significant responsibility assigned to CCA, MOF is the release of fund, transfer to the State Governments and Union Territories with Legislatures. These include the devolution of share of taxes, loans and grants, investment of the small saving collections from NSSF in State Securities.

- CCA, MOF also accounts for the internal debt of the Government of India as well as the receipts and withdrawals in the Public Account pertaining to Government schemes like Public Provident Fund and the other Reserve Funds.

- CCA, MOF undertakes settlement of personal claims including the retirement benefits of the employees of the Department.

- Another important function of the CCA is financial reporting. The monthly accounts and annual accounts for the Ministry of Finance are sent to the Office of the Controller General of Accounts for consolidation. The Scheme of Departmentalization of Accounts envisages a system of management accounts. CCA prepares monthly and quarterly review of receipts and expenditure for the information of the Secretaries of each Department.

- Internal Audit being the responsibility of the CCA, Ministry of Finance the Internal Audit Wing under his office undertakes the audit of Banks handling National Small Savings schemes such as Public Provident Fund & Senior Citizen Savings Scheme. Another wing of the audit carries on the routine propriety audit of all the offices discharging payment functions in the Departments of Ministry of Finance viz. the Cheque Drawing and Disbursing Offices (CDDOs) and Non-Cheque Drawing and Disbursing Offices (NCDDOs) and Pay and Account Offices (PAOs).

- In addition to above, there are certain other specialized functions discharged by the O/o Chief Controller of Accounts, as enumerated below :

- Release and monitoring of repayment of loans to Financial Institutions.

- Payment and settlement of pension payments in respect of pensioners of certain other countries settled in India.

- Accounting of loans from foreign governments and

- Preparation of consolidated accounts of total receipts and payments of all the Ministries/ Departments for CGEGIS and calculation of interests of the Savings Fund and Insurance Fund

- Chief Controller of Accounts, Ministry of Finance has earnestly undertaken the implementation of Public Financial Management System (PFMS) for e-payment, accounting and fund management across all PAOs of the Ministry. DDOs and Programme Divisions have also been trained and are processing the bills etc. through PFMS. All PAOs/DDOs and Programme Divisions are now using the PFMS portal for all payments which are being released electronically to the beneficiaries. E-bill has also been piloted successfully in PAOs.

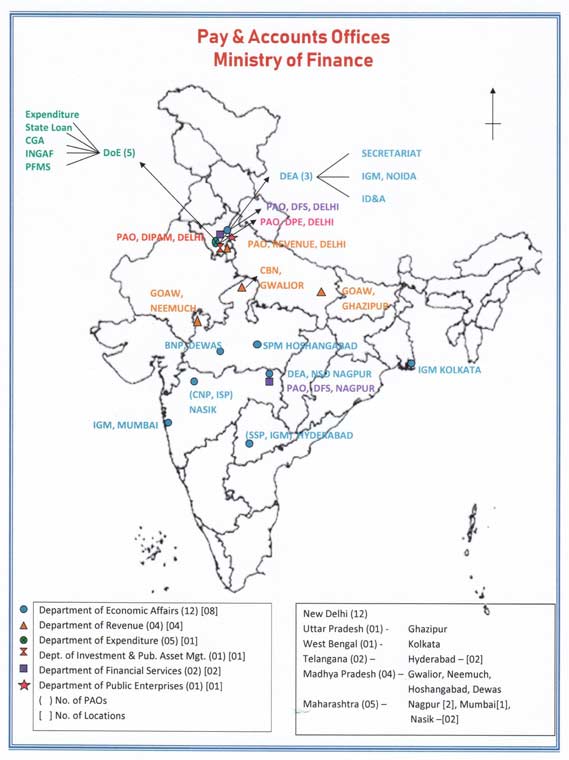

CCA, MOF has 25 PAOs all over the country to discharge the aforementioned responsibilities. There are in total 199 DDOs out of which 76 are CDDOs and remaining 123 are NCDDOs.

Functions of Chief Controller of Accounts - Office wise

Table Subject Sr. No. Name of Office Nature of Work 1 Principal Accounts Office - Consolidation of Accounts for all the Departments of Ministry.

- Preparing various financial statements, including the Annual Appropriation Accounts, Statement of Central Transactions, and Union Finance Accounts.

- Monitoring the payment of loans and grants to State Governments and manages payments through the Public Financial Management System (PFMS).

- Implementation of Direct Benefit Transfer (DBT) under the various Schemes of the Ministry as per guidelines and instructions issued by DBT Mission from time to time.

- Expenditure and Cash Management.

- Estimation and flow of non-tax revenue receipts.

- Monitoring of Assets and Liabilities.

- Finalization of Statement of Budget Estimates (SBEs), Detailed Demands for Grants (DDGS), Supplementary Demands for Grants, Re-appropriations, Revised Estimates (REs) relating to all the Grants of Ministry of Finance.

- Timely, accurate, comprehensive, relevant, and useful Financial Reporting for the Ministry.

2 Administration and Coordination Section - Administration and Establishment related functions including procurement of stores and outsourcing of services for O/o Chief Controller of Accounts.

- Disciplinary cases and complaints, Vigilance, Legal and RTI matters, Parliament Questions, Annual Performance Appraisal Report (APAR), Official languages and augmentation of manpower in the office, Training of Officials and other coordination related work for O/o Chief Controller of Accounts.

3 Pr. Accounts Office, NPS - Consolidate PAO registration form and forward it to CRA for registration.

- Monitor performance of PAO and DDO in discharging their responsibilities in CRA system.

- Monitor the resolution of grievances raised against PAO / DDO.

- Take necessary action to ensure compliance of PAO and DDO with the operational procedures of CRA system.

4 Internal Audit Wing - Assessment of adequacy and effectiveness of Internal controls in general, and soundness of financial systems and reliability of financial and accounting reports in particular.

- Identification and monitoring of risk factors (including those contained in the Outcome Budget).

- Critical assessment of economy, efficiency, and effectiveness of service delivery mechanism to ensure value for money.

- Providing an effective monitoring system to facilitate and course correction.

- Special/Risk Based audit of various Schemes and Programs of the Ministry to identify risk areas creating obstructions in achieving the targets of the Schemes and suggesting the remedial steps for the improvement of the performance of the programs.

- Audit of Public Sector Bank & Pvt. Banks assigned by DEA, MoF w.r.t. Small Saving Schemes i.e. Public Provident Fund-1968, Sukanya Samridhi Accounts-14, Senior Citizen Saving Scheme-04 & Kisan Vikas Patra-14 etc.

5 Internal Debt Accounts - Accounting of Internal Debt. IDA Section receives and compiles inputs from RBI Central Accounts Section (CAS) Nagpur, various PDOs/PADs of RBI and Budget Division of MoF and prepares head-wise monthly accounts.

- A Statement no. 14-A containing the Government Security / Bond wise opening and closing balances, additions and discharges are prepared on quarterly basis.

6 Pay and Accounts Offices - Payment of all types of bills and personal claims pertaining to Department.

- Bill Processing: PAOs handle the processing and pre-checking of all claims, bills, and salary payments for government employees and vendors within their purview.

- Payment Authorization: They authorize payments through e-payment portals or by issuing cheques.

- Accounting: PAOs maintain detailed financial records, including ledgers for General Provident Fund (GPF) and other relevant accounts.

- Processing of Pension cases: PAOs are involved in the processing and settlement of pension cases, including revisions and final payments.

- Authorization of Retirement Benefits: PAOs authorize retirement benefits for employees within their jurisdiction.

- Budget Allocation: PAOs play a role in the allocation of budgets to DDOs and other subordinate offices.

- Coordination with DDOs: PAOs coordinate with DDOs to ensure smooth financial operations and adherence to procedures.

- GPF Management: PAOs maintain GPF records, calculate interest, and issue annual statements.

- Pensioner Grievance Redressal: PAOs handle grievances related to pensions according to the Central Pension Accounting Office (CPAO).

Organization Chart

Secretary

Financial Advisor

Chief Controller of Accounts

Controller of Accounts

(Admin)

(Admin)

Controller of Accounts

(Accounts)

(Accounts)

Controller of Accounts

(Internal Audit)

(Internal Audit)

Deputy Controller of Accounts

Assistant Controller of Accounts

Deputy Controller of Accounts

Assistant Controller of Accounts

Sr. AOs/ AOs Stationed in NCR Delhi

- Sr.AO, Pr.AO (Admin)

- Sr.AO, Pr.AO(Accounts)

- Sr.AO, IAW

- Sr. AO, B&FI (IA)

- Sr.AO, PAO[DFS]

- Sr.AO, PAO[Estt],DEA

- Sr.AO, PAO, IDA

- Sr.AO,PAO [Revenue]

- Sr.AO,PAO, DPE

- Sr.AO,PAO, Expenditure

- Sr.AO,PAO, State Loan

- Sr.AO,PAO [Sectt.], DEA

- Sr.AO,PAO [DIPAM]

- Sr.AO,PAO, CAA&A*

- Sr.AO,PAO, IGM Noida

Outstationed Sr. AOs/ AOs

- Sr.AO,PAO, IGM Kolkata

- Sr.AO,PAO, SPP,Hyderabad

- Sr.AO,PAO, ISP Nasik

- Sr.AO,PAO, IGM, Mumbai

- Sr.AO,PAO, IGM Hyderabad

- Sr.AO,PAO, BNP, Dewas

- Sr.AO,PAO, CNP, Nasik

- Sr.AO,PAO, SPM, Hoshangabad

- Sr.AO,PAO, GO&AW, Ghazipur

- Sr.AO,PAO, GO&AW, Neemuch

- Sr.AO,PAO, CBN,Gwalior

- Sr.AO,PAO, NSO Nagpur

Sr.AO, O/o CAA&A (Encadered*): Delhi, Mumbai & Chennai