- Public Private Partnership Appraisal Committee Appraised Projects

- Viability gap Funding Scheme Projects (final Approved)

- India Infrastructure Project Development Fund Projects

- National Investment and Infrastructure Fund Scheme

- Special Window for Affordable and Mid-income Housing Scheme

- Monthly Economic Review

- External Debt Statistics

- Financial Market Monitor

- Financial Market Indicator

Public Private Partnership Appraisal Committee (PPPAC)

The PPPAC chaired by Secretary, DEA is the apex body for appraisal of PPP projects in the Central Sector. The has been set up with a view to ensuring speedy appraisal of projects, elimination of delays, adoption of international best practices, promotion of uniformity in appraisal mechanism and guidelines.

Total Project Cost (IN RS. CRORE) : 793,365.61

Viability Gap Funding (VGF)

Viability Gap Funding (VGF) scheme is a flagship scheme of the Government of India for providing financial assistance to financially unviable but socially/economically desirable PPP projects. The aim of the scheme is to attract more PPP projects and facilitate the private investment in PPPs in infrastructure, including the social sectors (Health, Education, Wastewater, Solid Waste Management, Water Supply etc.).

Total Project Cost (IN RS. CRORE) : 46,157.27

India Infrastructure Project Development Fund (IIPDF) Scheme:

The IIPDF Scheme provides funding to cover the PPP transaction costs to increase the quality and quantity of bankable PPP projects and reduce financial burden on Project Sponsoring Authorities (PSA) in respect of Transaction Adviser (TA) costs

Total Project Cost (IN RS. CRORE) : 70.55

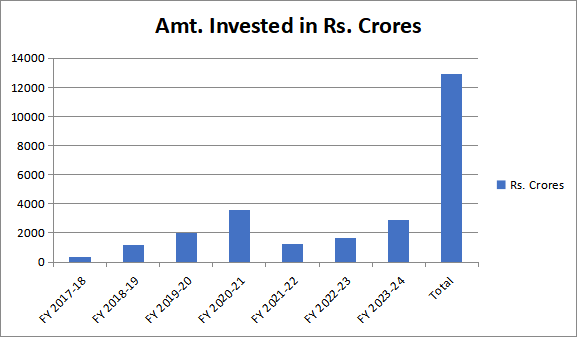

National Investment and Infrastructure Fund

The intention to create National Investment and Infrastructure Fund (NIIF) was to attract equity investments from both domestic and international sources for infrastructure development in commercially viable projects, both greenfield and brownfield, including stalled projects. NIIF was registered as a Category II Alternate Investment Funds (AIF) under SEBI Regulations. The Fund is managed by National Investment and Infrastructure Fund Limited (NIIFL). Currently, there are four funds under the NIIF Umbrella. The expenditure in NIIF Funds year-wise is as below:

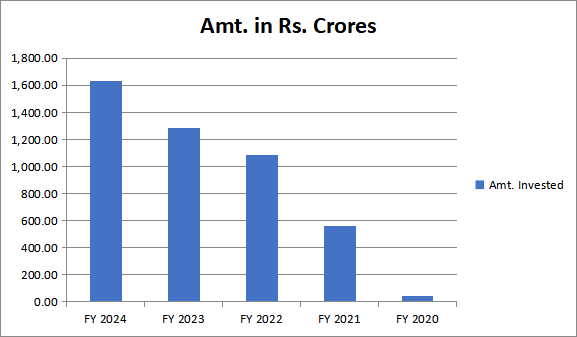

Special Window for Affordable and Mid-income Housing (SWAMIH) Investment Fund I

The Fund was incorporated in December 2019 to set up a ‘Special Window’ in the form of AIF to provide priority debt financing for the completion of stalled/stressed housing projects. The Fund is managed by SBICAP Ventures Ltd. a subsidiary of State Bank of India. The investment objective of the Fund is to complete construction of stalled / stressed residential development across geographies -pan India. The expenditure in SWAMIH Fund year-wise is as below:

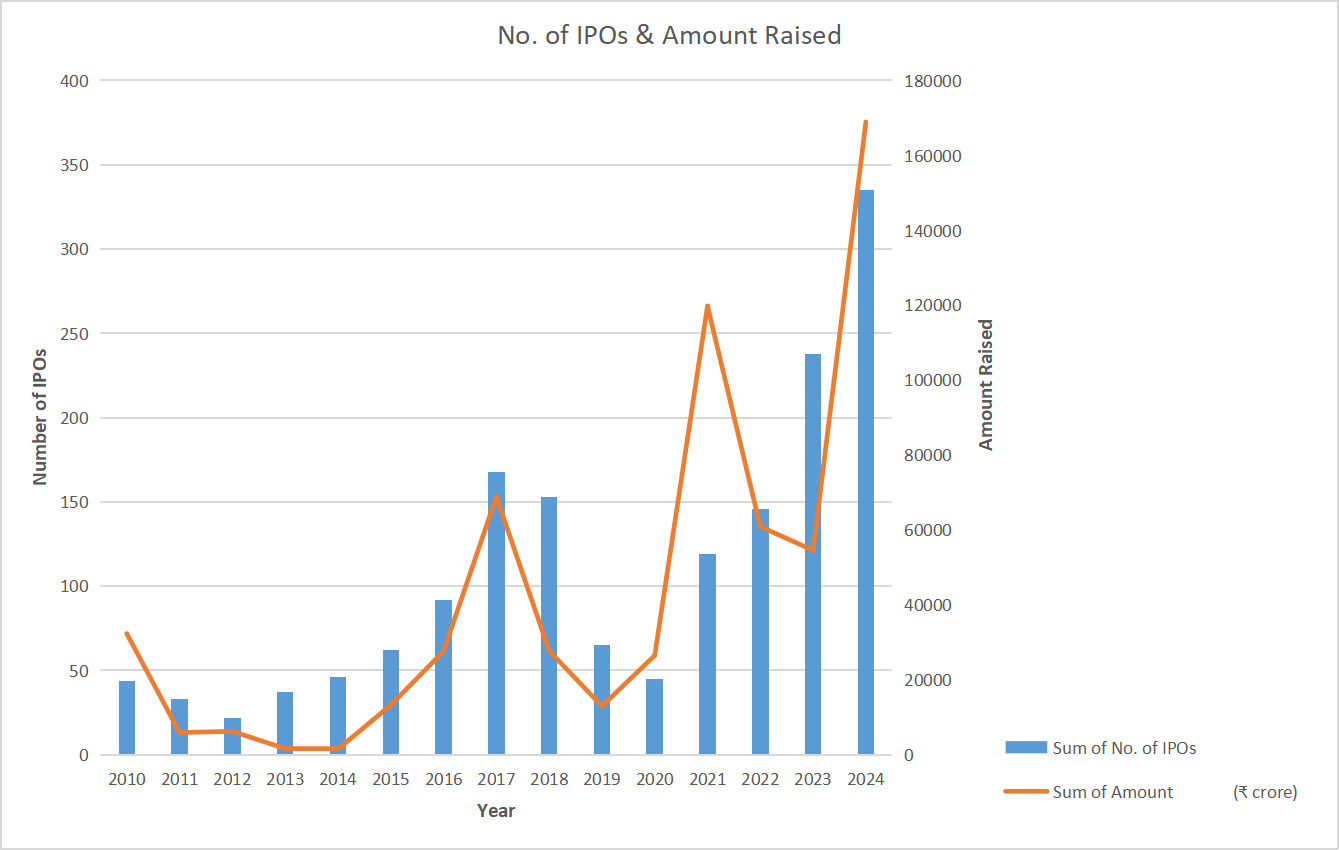

IPO

Year-wise details of the number of IPO issuance and the amount raised by them in Rs. Crores

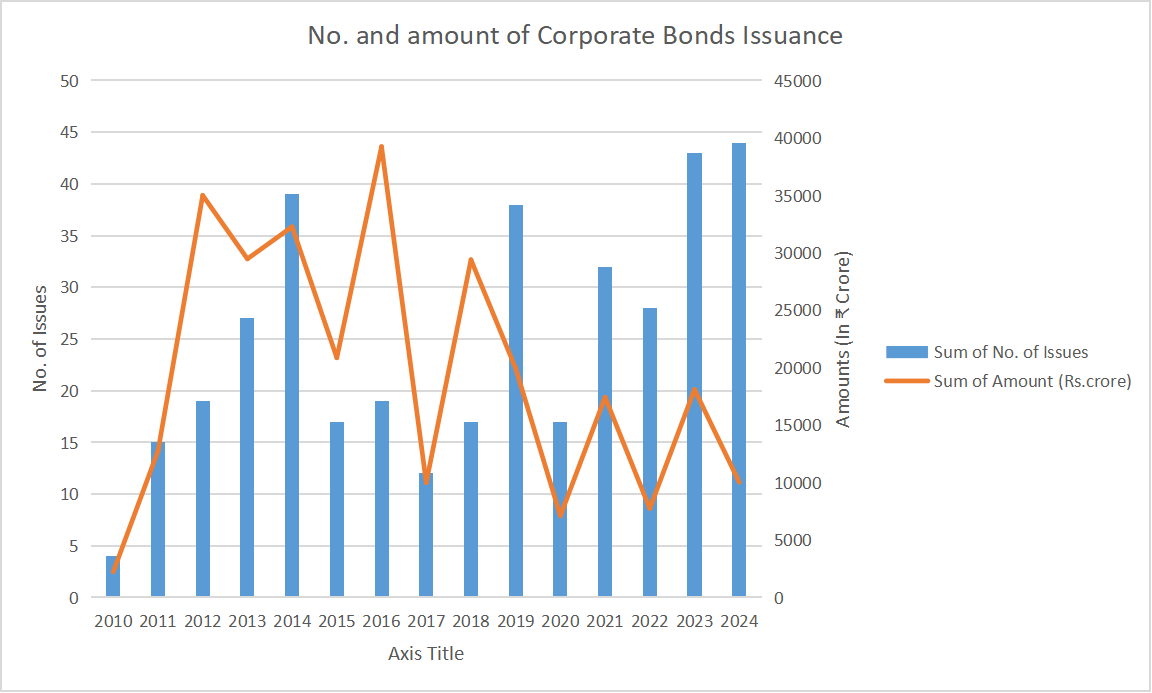

Corporate Debt

Year-wise details of no. of bond issuances and amount raised by them in Rs. Crores

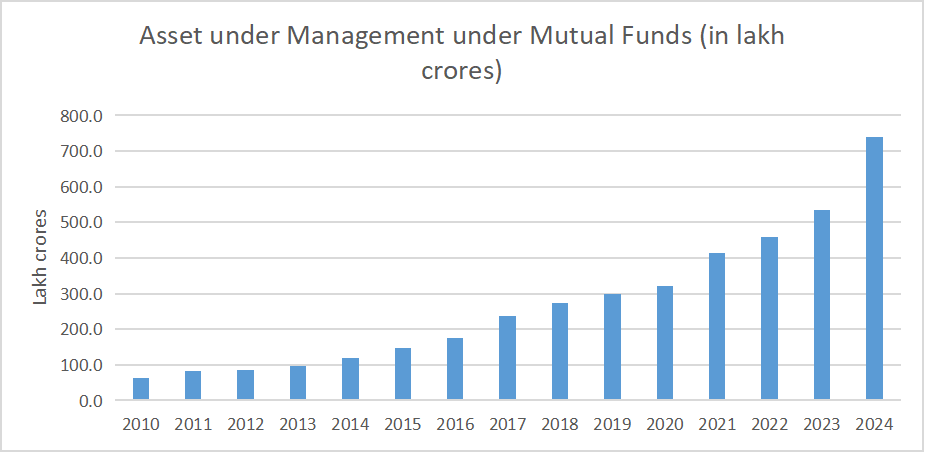

AUM under Mutual Funds

Year-wise cumulative Asset under management (AUM) under Mutual Funds in Rs. Crores

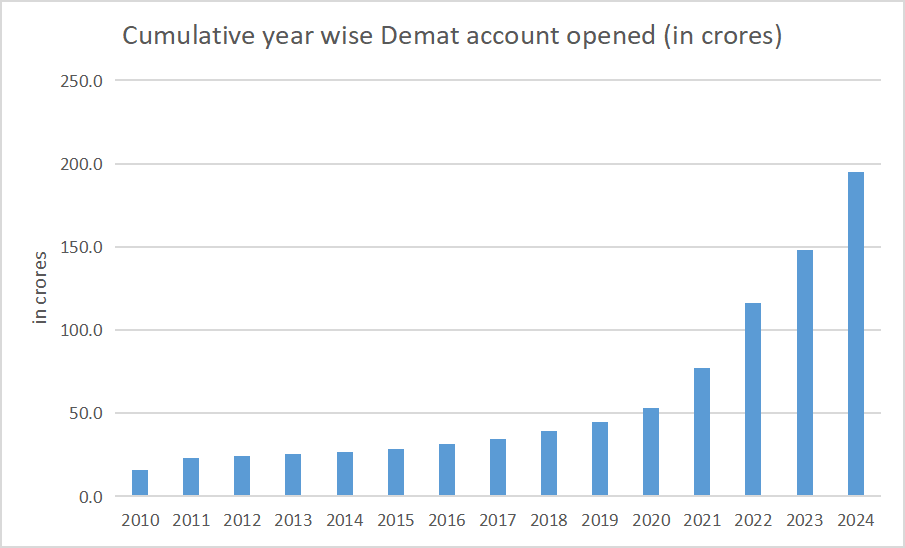

Demat Account

Cumulative Year-wise total no. of demat account opened in lakhs